L-QIF, New Opportunities For The Swiss Financial Markets

13.02.2024

I. Introduction

While Switzerland is globally recognised for its financial sector and tax regime, a combination of factors created a relatively unattractive environment for funds: high costs of set up and operation, lengthy approval processes, challenges in cross-border distribution (competition with the EU passport), and an unfavourable tax regime (withholding tax).

To address the issues of cost and time, the Swiss legislator has introduced a new category of funds, namely the Limited Qualified Investor Fund (L-QIF), which draws significant inspiration from Luxembourg's Reserved Alternative Investment Fund (RAIF) legal framework.

On January 31, 2024, the Swiss Federal Council decided to put the revised Swiss Collective Investment Schemes Act (CISA) and the amended implementing ordinance (CISO) into force with effect from March 1, 2024, thus creating the legal basis for L-QIFs.

L-QIFs will not create a new legal structure for collective investment schemes (CIS), but rather take the form of existing ones: they may be structured as (a) open-ended CIS in the form of contractual CIS or investment companies with variable capital (société d’investissement à capital variable) (SICAVs) or (b) closed-ended CIS in the form of limited partnerships for collective investment (société en commandite de placements collectifs) (LPs).

With a lightened regulatory regime, the L-QIFs are exclusively available to qualified investors within the meaning of art. 10 CISA (the Qualified Investors).

Qualified Investors include (i) professional and institutional clients as defined in the Swiss Financial Services Act (FinSA), including opted-out high-net-worth retail clients, as well as (ii) retail clients for whom a Swiss financial intermediary, a foreign financial intermediary subject to equivalent prudential supervision or an insurance company as per the Swiss Federal Insurance Supervision Act (FISA) provides portfolio management or investment advice within the scope of a permanent relationship, provided that they have not declared that they do not wish to be treated as such.

II. Set-up process and Supervision

While the CIS manager of the L-QIF will remain subject to authorisation under the Swiss Financial Institutions Act (FinIA), the L-QIF itself will not be subject to approval or subsequent supervision by the Swiss Financial Market Supervisory Authority (FINMA). Thus, the set-up process will be quick and cost efficient.

The institution responsible for the management of the L-QIF will have to notify the Swiss Federal Department of Finance (FDF) of its creation within 14 days[1]. The L-QIF and its manager will then be listed in a public register held by the FDF.

While FINMA will only indirectly supervise L-QIFs by exerting prudential supervision over the entities that manage these CIS, it will nevertheless have the authority to initiate proceedings directly against an L-QIF, should an L-QIF be offered to a non-Qualified Investor or should its management be carried out or delegated in violation of the legal requirements. Such an unauthorised activity is also punishable under criminal law. In other cases, FINMA may at most act against the institutions responsible for managing the L-QIF.

III. Management & Delegation

The management of L-QIFs and its delegation are set forth in art. 118g and 118h CISA.

In the context of CIS, management refers to all aspects of the CIS’ operations, including compliance with corporate or contractual law. The notion of ‘management’ covers investment-decisions, administrative tasks (e.g., risk management, compliance, accounting) and other activities related to the legal form of the CIS (e.g., non-transferable duties of the board of directors of a SICAV).

1. Contractual CIS

As for other types of contractual CIS, L-QIFs structured as such shall be administrated by a fund management company (direction de fonds) supervised by FINMA.

The investment decisions may be delegated to a Swiss manager of CIS authorised under FinIA (a Swiss CIS Manager)[2] or a foreign CIS manager under certain conditions of equivalence (together with Swiss CIS Managers, the Regulated CIS Manager). We underscore that a Swiss regulated manager of CIS, which manages CIS under the ‘de minimis’ rule, does not qualify as a Regulated CIS Manager (see the possibility to become a Swiss CIS Manager to manage a L-QIF under Section III.4. below).

The Swiss CIS Manager may then subdelegate the investment decisions to another Regulated CIS Manager (i.e., conditions of sub-delegation are the same as for the delegation).

2. SICAVs

L-QIFs structured as SICAVs shall delegate both the administration and the investment decisions to the same fund management company (direction de fonds). Under the L-QIF regime, SICAVs shall therefore exclusively be ‘externally managed SICAVs’ within the meaning of Art. 51 para. 2 CISO.

The fund management company may subdelegate investment decisions to a Regulated CIS Manager.

3. LPs

A fundamental principle of the LP structure is that the general partner (GP) is liable for the actions of the LP without restrictions, whereas the limited partners’ liability is limited to their contributed capital. The GP shall be a Swiss-based company structured as a company limited by shares (société anonyme).

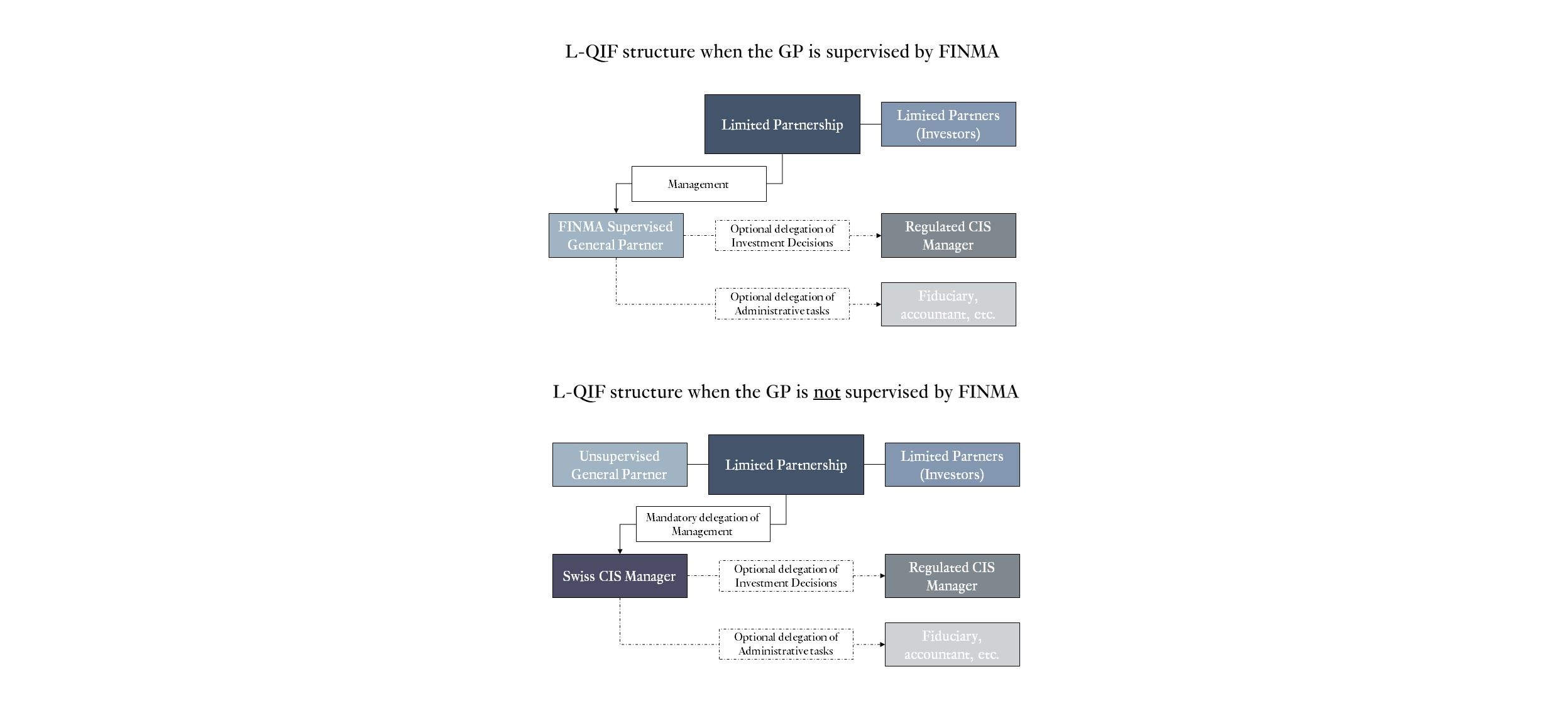

It is important to note that the GP is not obliged to obtain an authorisation from FINMA to act as the GP. However, if it is not authorised by FINMA, it may not act as GP of several LPs. In the context of L-QIF, either the GP is itself authorised by FINMA as a Swiss CIS Manager, or the management of the L-QIF is delegated to a Swiss CIS Manager by law.

In the latter case, the prudential obligations lie with the Swiss CIS Manager rather than with the unsupervised GP. The GP’s compliance is limited to meeting the requirements of possessing a good reputation and the specialist qualifications necessary for its role. The compliance monitoring falls under the responsibility of the Swiss CIS Manager[3].

In our view, the technical expertise required from the unsupervised GP should be minimal since the management of the L-QIF is legally entrusted to a Swiss CIS Manager which assumes the entire prudential responsibility[4].

The limited partnership agreement must mention to whom the management is delegated.

Whether the management is performed by a FINMA-supervised GP or a third-party Swiss CIS Manager, the investment decisions may, as for the other legal forms of L-QIFs, be delegated to a Regulated CIS Manager.

Furthermore, the outsourcing of administrative tasks such as tax filing and accounting may be subdelegated to third-parties within the same framework as with existing CIS.

4. De Minimis Managers of CIS

The so-called ‘de minimis’ asset managers may manage CIS with a portfolio manager’s licence, provided that (i) only Qualified Investors invest in such CIS, and (ii) the assets of such CIS fall below certain thresholds. Such ‘de minimis’ managers are not allowed to manage L-QIFs.

Nevertheless, those ‘de minimis’ managers may opt in to become Swiss CIS Managers[5]. To that end, such managers will have to file an application with FINMA to obtain their license as Swiss CIS Manager.

IV. Legal Framework

1. Reduced Regulatory Burden

The overall regulatory burden of L-QIF will be lighter than any other type of Swiss CIS.

Firstly, since FINMA is not involved in the supervision of L-QIFs, all the provisions of CISA granting decision-making authority to FINMA will not be applicable.

Secondly, most investment regulations do not apply to L-QIFs which, for example, will be permitted to invest all of their funds into one single asset (e.g., shares of a single company) or into one single asset class.

Thirdly, it is also worth noting that the CIS obligation to redeem shares or units to investors may be waived under certain conditions.

Fourthly, L-QIFs will be exempt from the obligation to draw up a prospectus.[6]

Despite this considerable freedom, the new CISO limits L-QIFs in some ways by mirroring existing restrictions applicable to other CIS categories. Most of these restrictions apply to SICAVs and contractual CIS, such as the minimum level of assets and limitations of leverage and collateral. LPs are exempt from most of the L-QIF specific restrictions. LPs are only required to explicitly mention their investment policy and related risks in the limited partnership agreement. Finally, real estate LPs are subject to restrictions (i) if such LPs carry out transactions with closely related persons or (ii) when appointing real estate valuation experts to value the real estate assets belonging to the LP.

2. AML Obligations

Currently, fund management companies (direction de fonds), Swiss CIS Managers, and SICAV/LP entities fall under the Swiss Anti-Money Laundering Act (AMLA). Contractual CIS, being non-legal entities, are excluded from the regulatory scope.

Under the upcoming legal framework, L-QIFs structured as LPs or SICAVs will not be subject to the AMLA. Nevertheless, given that these CIS entities will be administered and managed by entities already subject to the AMLA, this change will be mostly administrative since it will release the CIS from being registered with a self-regulatory anti-money laundering organisation.

3. Accounting and Audit Specificities

A financial audit of the L-QIF shall be conducted annually, with an additional ‘complementary’ audit – prudential audit addressing the specificities of the L-QIF – to be conducted biennially.

The L-QIF shall be audited by the same auditor responsible for auditing the CIS administrator or manager. The associated expenses shall be borne by the L-QIF.

4. Tax Regime

L-QIFs are subject to the same tax regime as other FINMA-regulated CIS.

The CIS itself is not taxed, except for real estate CIS, which are subject to income tax on the returns on their real estate holdings. Otherwise, taxation of the L-QIF’s income and assets are levied at the investor’s level.

For more information on this topic, please refer to our presentation dated April 21, 2023, which is available on our website under:

https://www.jacquemoudstanislas.ch/en/news-publications/bulletins/2023/april/distribution-of-collective-investment-schemes-in-switzerland-to-qualified-investors/.

V. Conclusion

Addressing issues of time and cost, L-QIFs represent an attractive solution for sponsors looking for an investment vehicle focusing on capital gains, such as PE or VC funds, and real estate assets. While Europeans may still opt for EU passported funds, the L-QIF is likely the best solution for Swiss-based and international investors seeking a quick and cost-effective option.

Finally, as L-QIFs will also have the ability to convert themselves into other types of CIS, it will be possible to establish a CIS as an L-QIF for a swift setup to then apply for a FINMA authorisation at a later stage.

Jacquemoud Stanislas has advised multiple Swiss CIS Managers in connection with their investment structures based in Luxembourg and is keen to use its knowledge gained over the past 10 years in the implementation of the L-QIF for Swiss CIS Managers.

[1] The content of this notification is detailed art. 126g CISO.

[2] Swiss CIS Manager also includes (i) banks, securities firms, and fund management companies, as per the authorisation chain set forth in art. 6 FinIA, and (ii) insurance companies under FISA and art. 9 para. 2 of the Swiss Financial Institutions Ordinance (FinIO).

[3] As per the commentary published by the FDF on January 31, 2024.

[4] Art. 126h para. 1 of the new CISO.

[5] The pre-existing procedure is detailed in art. 24 para. 3 FinIA cum art. 36 FinIO.

[6] As per the new art. 50 al. 1 FinSA.

Si vous avez des questions en lien avec ce bulletin, merci de contacter: